I recently noticed several bloggers announcing a dramatic slip in the Amazon cloud business based on a drop in revenue of the infamous Other category. While deducing AWS revenue from changes to the Other category is an inexact science, it is the best we have until Amazon choose to break out AWS as a line of business in their SEC filings.

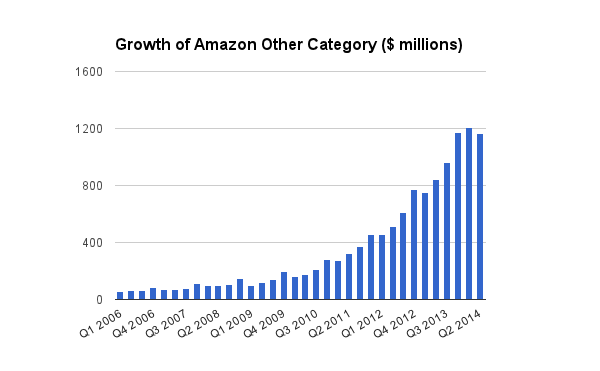

It's true the torrid end of 2013 growth of the Other catgeory ($960M in Q3 to $1170M in Q4) flattened in Q1 2014 (+3% to $1204M), before declining in Q2 (-3% to 1168M). But before everyone makes sweeping generalizations of what this means to Amazon's cloud business, it's worth a look at the cyclical nature of the Other category.

As you can see from the chart, revenue in this category regularly declines in Q1, rebounds modestly in Q2, and then proceeds to accelerate dramatically in Q3 and Q4. The most recent drops in revenue of the Other category include Q1 2013 (-2.5%), Q1 2012 (-0.2%), Q1 2011 (-2.1%), Q1 2010 (-22.64%), Q1 2009 (-45.5%), and so on. Notice a pattern?

There is no doubt Amazon's April price decrease in response to Google was at least in part responsible for the slip in revenue. But at the same time, that was the 42nd price decrease since 2006.

So take relax, take a deep breath, and don't draw sweeping conclusions on a slowing growth in the cloud from what is likely a cyclical pattern that has repeated itself consistently since 2007.