I started the New Year off with a punch list of long neglected technologies I wanted to learn. Last week I checked the first item off the list: Non-Fungible Tokens (NFTs). I know it’s hard to believe that in the year 2022 I am still an NFT neophyte. Somewhere between growing my last company and taking time off, I just never found the time to make sense of this market.

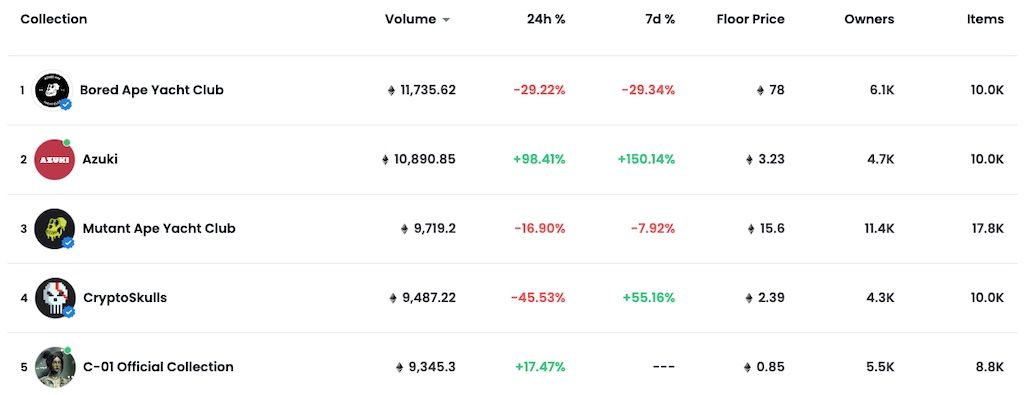

But last week I did a deep dive into the wild and crazy world of NFTs. I researched the market, took a closer look at the key players, read the numerous specs, wrote some code, and even minted, bought and sold my first NFTs. Now before you get too excited, I should admit that while I have a much better sense of the market, I am most definitely a novice. I’m also not a very good NFT investor (a more experienced one might accuse me of having “paper hands”). So you won’t see me purchasing a $69M Beeple for my digital art gallery or a $462K Bored Ape Yacht Club image for my Twitter profile. But here some initial thoughts from a new NFT investor:

NFTs Are Not the Fad I Thought They Were

NFTs provide an owner certification that a digital asset - e.g. song, photograph, video, art - is both unique and authoritatively owned. By leveraging blockchain, they ensure a transparent and tamper-proof ownership of an asset. They also provide owners and buyers anonymity in their transactions, and allow them to perform them without intermediaries. Using an NFT standard such as EIP-721 on top of Ethereum blockchain, they allow you to implement fully automated smart contracts that would otherwise be hard to do in a physical world - such as providing the original creator of a work a royalty on resale. There are also some interesting innovations around “functional NFTs”: digital assets that convey some value in the physical or virtual world, such as access to a restaurant or membership in a club.

As much as I came to NFTs as a skeptic, it’s hard to view this technology as just a fad. As the world continues to go digital, an increasing number of the assets we own will also be digital. NFTs layered on a blockchain network provide a powerful solution to managing, selling and buying digital assets. In short: I'm a believer now that NFTs are here to stay.

Many Early Use Cases Are a Bubble Waiting To Pop

Okay, now let me unleash the skeptic. There are four primary use cases for NFTs today:

- Art - E.g. I want to own a Beeple.

- Collectibles - E.g. I enjoy collecting CryptoKitties.

- Investment - E.g. I buy PudgyPenguins and sell them for a profit.

- Status symbol - E.g. I want the cachet of my Twitter profile being a Bored Ape Yacht Club image.

Unfortunately there is definitely some “irrational exuberance” happening in each of these use cases. For example, would you pay a one-time fee of between $14K-28K for the right to make a reservation at a New York City restaurant? Or $16.9M for 9 pixelated images that look like they came straight off a Windows 95 desktop? These transactions show the market is conveying exponentially greater value - possibly irrational value - for a digital asset because it is an NFT.

Economic bubbles occur when investors drive the perceived price of an asset beyond any real / sustainable value. A classic historical example from the 1600s was the “Tulip Mania” in Netherlands, in which a speculative market arose around tulip bulbs, driving prices to stratospheric levels. While some bubbles correct themselves gradually, others do so quickly - wiping out the wealth of many in investors in the process. In the case of NFTs, we have no historical precedents to help us understand what will happen to the value of these assets in an economic downturn. We don't even have enough data yet to confidently value digital assets.

I had to remind myself several times during my deep dive that these technologies - e.g. cryptocurrency, blockchain, NFTs, DAOs - were all born in a boom economy. None of them have had to weather a recession yet. But with the low barrier to entry allowing creators to flood the NFT market with new digital assets every day, it seems hard to believe there is not a correction of some kind on the horizon.

Decentralization Is a Myth

One of the much touted values of cryptocurrency and NFTs is decentralization. I can anonymously transfer currency from my digital wallet to a seller without requiring a bank or financial institution to authorize, validate or execute the transaction. I can even use a software-defined smart contract to enforce the agreed upon terms purchase - e.g. the transfer of ownership, the payment of royalties. And I can do all of this without any company or organization in between. Instead all these transactions occur on computer infrastructure run anonymously by masses of organizations and individuals.

In a world in which people no longer trust in centralized authorities, this is a powerful concept. But it’s also not the full story. For example, to purchase an NFT, you will likely set up a Coinbase wallet (NASDAQ: COIN, $46B market cap), add a MetaMask wallet to serve as a gateway to the various blockchain apps (ConsenSys has a $3B+ valuation and is nearing an IPO). And then of course I need to purchase my NFT from a marketplace such as OpenSea (pre-IPO, expected to have $13B+ valuation). So yes, while the underlying infrastructure powering NFTs are fully decentralized and not in the control of traditional Big Tech, you are still interacting with a new emerging set of centralized companies. In many ways, we are seeing the emergence of new powerbrokers in the tech industry - i.e. Big Crypto.

Gas Fees Are Prohibitively Expensive

The decentralized network supporting the infrastructure for cryptocurrencies does not come for free. In a proof-of-work network, each transaction requires engaging this network in validating the authenticity of the transaction and recording it in the blockchain. The cost from the network for doing this is called a gas fee, which is paid in cryptocurrency. Gas fees vary based on the demand on a network. It is common for NFT buyers to choose to accelerate the speed and probability of their transaction succeeding by committing to higher fees, and to be rejected due to insufficient fees.

Due to the popularity of the Ethereum network, the demand on the network is getting higher each week. The result: increasing gas fees. This is particularly noticeable during popular events, such as the release of a new NFT collection when 100K users compete to purchase 10K items. In addition to getting charged gas fees on a purchase, there are a myriad of charges in an NFT marketplace - e.g. setting up access between the marketplace and your wallet, listing an NFT, accepting an offer, transferring an NFT, canceling a bid, and more. These fees can range from a few dollars to $50+. My largest fee was $252, which was a one-time OpenSea gas fee to list NFTs in the marketplace.

Now of course there are alternatives to Ethereum - e.g. solana, avalanche. There are also solutions on top of Ethereum such as Polygon, which use a sidechain to eliminate the gas fees. While this may sound great, it imposes some additional complexity on buying and selling NFTs, thus reducing the size of the marketplace and potential value of the listed assets. Sidechain users must accept some additional risk around security and scalability. In short: until a technical solution comes along (e.g. Eth2), or the marketplaces move to less utilized / more scalable blockchains, gas fees are likely to be an impediment for NFTs to reach an early majority market.

Last Thoughts

While I started my deep dive into the NFT world with a healthy skepticism, I would say I am cautiously optimistic now on this market. Yes, the NFT market is highly speculative today, reminding me in many ways of late 1990s day trading. For those of you who didn’t live through this era, it seemed like everyone was making money day trading right up until the Dotcom Bust - which wiped out $5T in wealth in what seemed like an instant. But in spite of the deep recession that followed, the technologies from the Dotcom Boom continued forward, reshaping the economy and powering the next two decades of economic growth.

The underlying technologies on which the NFT market is built - smart contracts, cryptocurrency, blockchains, digital wallets, marketplaces - are powerful and durable, and will likely be around for many decades into the future. In short: I am bullish on the future NFTs… but just not quite ready to drop $400K to flex on my Twitter profile.